A Brief Overview of Index-Linked Annuities

The first generation of Fixed Indexed Annuities (FIA) launched in the mid-1990s were a revelation. A struggling bond market coupled with equity volatility was the perfect storm for the arrival of the FIA. Investors saw the magic of the Fixed Indexed Annuity: allowing a client principal protection while also gaining exposure to the performance of an external index using call options (an index-linked crediting strategy). A client’s initial principal and any earned interest would be locked-in annually and safe from downside market risk.

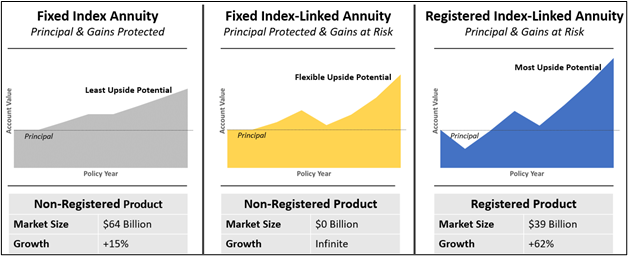

In 2010, AXA Equitable released the first product of a category that is now commonly referred to as a Registered Index-Linked Annuity, or RILA. What separates a RILA from an FIA is simple – a RILA is a registered securities product, not a fixed insurance product. Like FIAs, RILAs combine fixed income yields with derivatives to provide index-linked exposure, but RILAs can offer index-linked crediting strategies that have not traditionally been available in FIA products. These strategies put the client’s principal and previously earned credits at risk to generate more upside potential with some level of defined downside protection from losses.

With FIA, the client can lose nothing but has less upside potential. With RILA, the client could lose everything but has more upside potential. There was a clear and obvious gap in the market that needed to be filled by a product that combined the principal protection of a fixed insurance product with the potential to take more risk and earn more upside exposure, similar to RILA.

FILA – The Next Generation of Index-Linked Annuities

Enter a new breed of FIA that is colloquially referred to as a Fixed Index-Linked Annuity, or FILA. The concept behind a FILA is remarkably simple – allow clients to take downside risk to the extent of previously tracked gains to have more upside potential. The FILA variant of FIA slots directly between a traditional FIA and RILA.

How Does a Fixed Index-Linked Annuity Work?

At its core, a FILA allows the policyholder to put their previously earned (tracked) gains at risk to have more upside exposure. At no point in time can the policyholder select an account with negative exposure such that, in the event of a full loss, would pierce the policyholder’s principal. This is one way that FILA ensures it’s clearly a fixed insurance product and not a security.

Furthermore, the policyholder is under no obligation to risk their gains – at any point in time, they can simply allocate to an index-linked option with a 0% floor. In doing so, the FILA would replicate the performance of an FIA and have complete downside protection. If they have previously tracked gains, clients can choose accounts that provide similar index-linked crediting parameters as a RILA.

What Separates a FILA from a Traditional FIA?

Every FILA is an FIA but not every FIA is a FILA. As of this writing, there’s currently one FILA product in the marketplace – American Equity’s FlexShield. As more companies inevitably enter this space, the definition of a FILA will assuredly change as well. But from what we can see so far, a FILA has the following structure:

How Are Rates Determined in a FILA?

Because FILA uses true one-year index-linked tracking periods, the rates and ratesetting process for FILA should be nearly identical to traditional FIA and RILA. All three products hedge on an annual basis and set rates based on the market price for hedges and available investment yield. All else being equal, rates in a FILA product should be market-competitive for similar payoff structures with both FIA and RILA.

Why Would a Client Choose a FILA over a Traditional FIA?

In our view, the real question is why wouldn’t a client choose a FILA over a traditional FIA. The client can achieve identical performance to an FIA by using a FILA, but the FILA offers the ability to modify the risk and return profile of the product over time. The power of a FILA is that it isn’t one thing – in some circumstances, it can look like an FIA and, in others, it can be very close to a RILA. It’s an incredibly valuable proposition that, by virtue of its principal protection, is filed, priced and distributed just like any other fixed or fixed indexed annuity product.

We believe that FILA is the next generation of FIAs, combining the best attributes of traditional FIA products with the best attributes of the rapidly growing RILA market. Welcome to the future.