The Basic FILA Concept

As we covered in The Emergence of the Fixed Index-Linked Annuity (FILA), the core definition of a FILA product is an FIA that allows the policyholder to access index-linked crediting options that have more downside risk and more upside potential than a typical FIA and akin to what is available in some RILA products. However, unlike a RILA product, FILA restricts access to crediting options with downside risk only to policies with sufficient previously tracked gains to withstand the worst-case negative credit without piercing the policyholder’s principal. The concept itself is very simple – the policyholder can take as much risk as previous gains allow in order to get more upside potential – but is the product as straightforward as it sounds? For that, we have to dive a bit deeper.

The Multi-Year Indexed Crediting Account

In terms of the base product chassis – surrender charges, compensation, MVA formulas and other base contract elements – FILA products are identical to traditional FIA products. The difference between a FILA and an FIA product is the presence of a multi-year indexed crediting account that does four things:

The Tracking Value at Risk Calculation

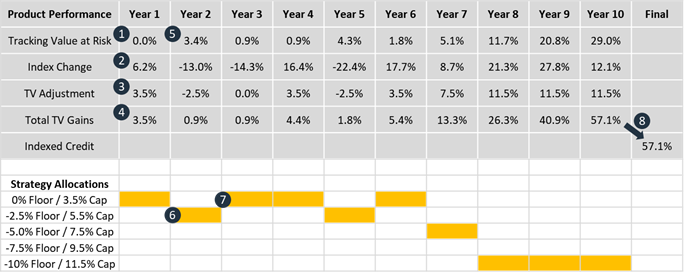

At the heart of the FILA concept is the Tracking Value at Risk mechanism to restrict the availability of strategies with negative adjustments only to policies with sufficient gains in the Tracking Value. TVAR is not a part of the actual calculation of indexed credits in any way. It is simply a way to limit the allocation choices available to each policyholder based on their specific policy values and, without it, FILA could not exist.

The actual TVAR calculation answers a simple question – what is the maximum negative credit that the Tracking Value could receive without falling below principal? In mathematical terms, the answer is a simple ratio: 1 minus Account Value divided Tracking Value.

Example: A policy with $100,000 in Account Value and a Tracking Value of $125,000 has TVAR of 16.67%.

Applying TVAR to Strategy Allocation Choices

As a simple rule, a policyholder can only allocate to strategies where the TVAR is larger than the maximum negative index-linked adjustment. For example, if the maximum loss for a particular strategy – regardless of whether it uses floors, buffers and/or participation rates to calculate the loss – is 10%, then only policies with TVAR greater than or equal to 10% can allocate to that strategy. Crucially, FILA allows the policyholder to allocate to any strategy with a maximum loss is less than or equal to TVAR, including the core 0% Floor strategies.

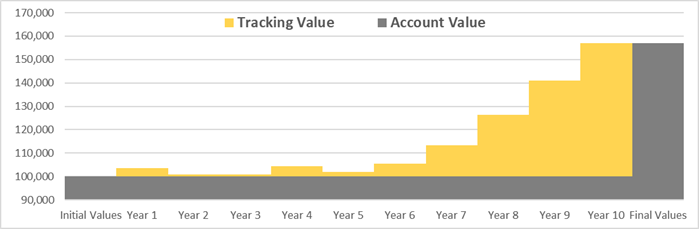

With just these core elements and mechanics, we can bring the basic concept of a FILA to life. For this example, we’re going to assume that the product has five S&P 500-based strategies within the multi-year indexed crediting account, all of which use annual point-to-point crediting with a cap at the specified floor level.

Are Caps, Participation Rates, Spreads, Floors and/or Buffers only to gains or to the whole Tracking Value?

In FIA and RILA products, any of the above elements always applies to the full Account Value allocated to the particular crediting strategy. With FILA, the Account Value in the multi-year crediting strategy only receives an indexed credit at the end of the account term, but the Tracking Value receives index-linked adjustments at least on an annual basis. Any Cap, Participation Rate, Spread, Floor and/or Buffer is applied to the full Tracking Value allocated to the particular strategy.The sole and solitary purpose of tracking gains is that the final indexed credit to the multi-year indexed account is equal to the gains in the Tracking Value as a percentage of the Account Value.

Is the policyholder required to allocate to any particular account?

No – at least, there is no mechanical reason why the client would have to. One of the most powerful and attractive features of the FILA chassis is the choice and flexibility that it gives to clients in selecting their desired risk and return profile on an annual basis. However, it is most likely that life insurers introducing FILA products will allow the client to set a maximum desired risk level when the policy is issued and that can be changed prior to any policy anniversary so that the allocations can be automatically selected up to the maximum specified risk level. For example, a client could set a maximum risk level of a -10% credit and the FILA would automatically allocate the Tracking Value to accounts with risk up to -10% depending on what is allowed by TVAR.

How do withdrawals affect the mechanics of the multi-year account?

There are a variety of ways that withdrawals could be treated under the FILA concept, but withdrawals do not fundamentally change the mechanics of the account. Any withdrawal would be deducted either on a pro-rata or dollar-for-dollar basis from the Account Value that has been allocated to the multi-year indexed crediting account. The new, reduced Account Value would continue to be used to calculate TVAR and, therefore, which strategies are available for allocation. TVAR is almost always increased as the result of a withdrawal.

How are values calculated between policy anniversaries?

Because FILA involves the potential for negative adjustments, the Tracking Value will likely be adjusted on a daily basis to take into account the constant movement of the index. As with RILA products, the exact formula for translating index movements into intra-year adjustments to the Tracking Value will vary by company.

Is the full Tracking Value available for withdrawal or surrender?

No – at least, from our vantage point, it shouldn’t be. Although the Tracking Value could serve as the basis for free withdrawals, non-free withdrawals, full surrender and on death, it is a part of a multi-year crediting strategy and there will likely be gains in the Tracking Value that cannot be accessed immediately and either are available only at the end of the term or vested over time. We expect that companies will differentiate their FILA offerings at least in part based on the degree to which the Tracking Value is available for policy transactions prior to the end of the multi-year indexed crediting strategy.

How are FILA rates set and hedged?

As with any other FIA product, FILA is hedged using options on the underlying indices used for index-linked crediting. The non-guaranteed elements of the crediting strategies – the participation rates, spreads and caps – are adjusted on an annual basis depending on the market price for options. Rates in FILA should mirror rates in FIA products for the same 0% Floor and rates in FILA should resemble rates in RILA for the same downside risk.