There is no question that the insurance industry has been buoyed by the recent period of rising interest rates precipitated by the Federal Reserve’s increases to the Federal Funds rate. Corporate bond yields have also increased significantly since the beginning of 2022 with rising interest rates. This has allowed U.S. insurers to reinvest proceeds of maturing corporate bond investments at greater yields than those rolling off. Nowhere has the impact of higher investment yields been more apparent than in the market for multi-year guaranteed annuities (MYGAs).

MYGA products are simple – they pay a guaranteed return over a specified period of time. As a result, MYGA sales are heavily dependent on the rate being offered by the life insurer. Higher rates almost always mean greater sales. That’s certainly what we saw in 2022, when MYGA sales more than doubled over the year before. While this is generally seen as good news for the industry, the burst of popularity of MYGA has also brought some unexpected challenges.

Actuarial Mathematics

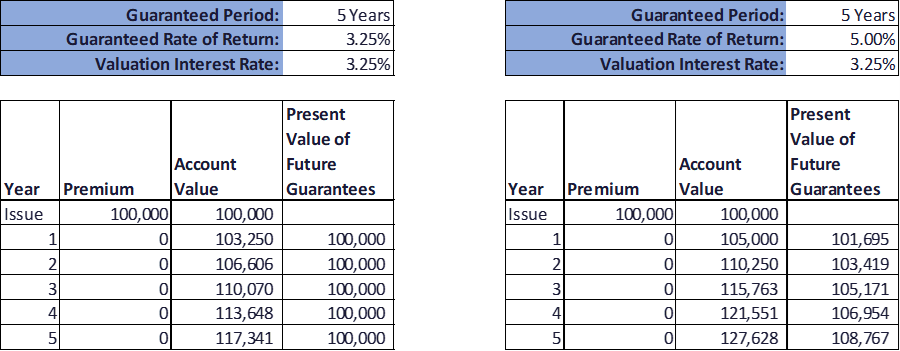

When a life insurer sells a life insurance or annuity policy, it has to set aside reserves that are designed to cover the expected future cash flows generated by that product. In the case of MYGA, insurers project the future guaranteed cash flows based on the Guaranteed Rate of Return and then discount these amounts back to the issue date using a Valuation Interest Rate, which is currently set at 3.25% for 2022 for most MYGA products. The year with the highest present value of future guaranteed cash flows becomes the reserve amount. This reserving methodology is referred to as the Commissioners’ Annuity Reserve Valuation Method, or CARVM.

In the case where the MYGA guaranteed rate of return is equal to the valuation rate, the reserve equals the premium (Example 1). However, as the guaranteed rate of return exceeds the valuation rate, the policy reserve increases accordingly (Example 2). Any additional reserve that the life insurer has to post above premium is essentially paid out of the insurer’s pocket, a concept referred to as “strain.”

Valuation Rate Determination

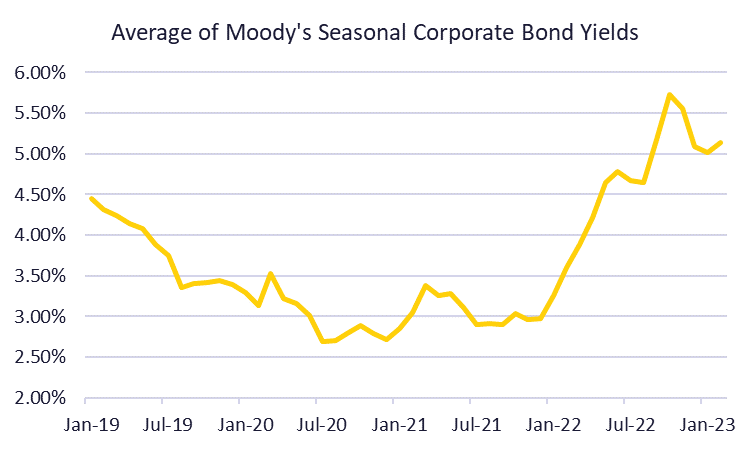

In 2022, Example 2 played out right before our eyes. Interest rates dramatically increased and drove MYGA offered rates through the roof, but the Valuation Rate was slow to catch up. That’s by design. The Valuation Interest Rate is determined using a formula based on the rolling average yield of seasoned corporate bonds. It’s meant to be relatively slow and stable. The reference rate for any given year for an annuity with a Guaranteed Period less than 10 years is equal to the the average yield over the previous 12 months ending on June 30 of the year the policy is issued. Moody’s Investors Service publishes these average yields each month, and the monthly averages are used in the calculation.

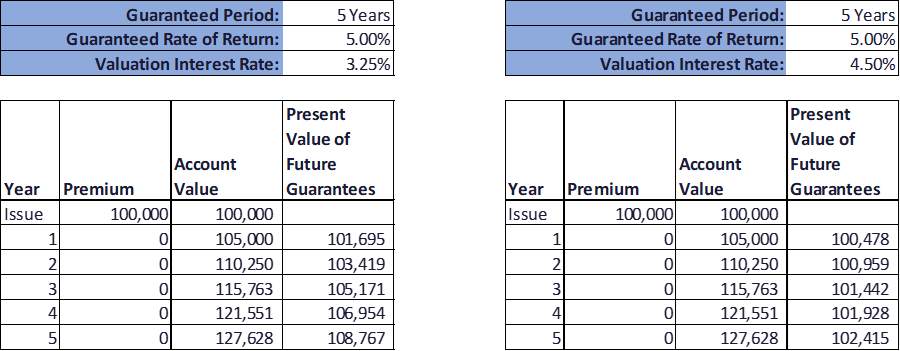

The valuation rate formula for a common MYGA only considers 65% of the difference between the reference rate and 3%, which creates a natural anchor in the valuation rate centered around 3%. As rate guarantees drift above 3% the gap between credited rates and valuation rates grows, creating more strain. The higher interest rates rise, the higher the Valuation Interest Rate will go, although due to the 3% anchor the valuation rate are likely to continue to diverge from the crediting rate. MYGAs saw increases in Valuation Interest Rates between 25-50 bps from 2021 to 2022, with most products using a rate of 3.25%. Projecting the February 2023 rate forward through the end June 2023, the valuation rate for 2023 would increase another 100-125bps with most MYGA products using valuation rates of 4.5%. This will have a profound effect on reserving for MYGA products and the size of the “strain” incurred by life insurers while writing MYGA business.

Actuarial Mathematics Revisited

Using our previous example of a 5-year MYGA earning a 5% Guaranteed Rate of Return, an increase of the valuation rate from 3.25% to 4.5% would mean a $6,000 reserves savings on $100,000 of premium.

Strain Economics and MYGA Market Impacts

The problem with strain is that it has to be paid back at the carrier’s cost of capital. How does that happen? By the life insurer taking an increased investment spread and paying a lower net guaranteed yield to the policyholder. Every dollar of strain results in lower guaranteed yields for policyholders.

That’s why the increase in the Valuation Interest Rate is such a big deal. Looking at the example above, a $6,000 reduction in strain would allow for life insurers to pass between 0.2% and 0.25% higher yields through to policyholders without affecting the profitability of the life insurer. This is nothing but good news for consumers.

On top of that, reduced strain will also allow life insurers to sell more MYGA for the same dollar of available capital. If the all-in strain for a MYGA with a 5% guaranteed rate was 16% in 2021 – a figure that includes not only reserves determined by CARVM but also statutory Risk Based Capital requirements – then it would fall to just 10% in 2022. For a company with $100 million in statutory capital available to fund new business, their capacity for new MYGA sales would balloon from $625 million to $1 billion. As a result, we expect the MYGA market to remain highly competitive in 2023, with companies continuing to battle for marketshare and leveraging the improved economics for MYGA into higher rates offered to consumers, even if overall market interest rates remain flat.