Introduction

Many economists would define two consecutive quarters of economic contraction as a recession. GDP fell 1.6% in Q1 2022 and .9% in Q2 2022. According to Blackrock, since 1926, the average length of a recession in the United States is approximately 12.6 months. However, after navigating the short-term pain of an economic pullback, the average expansion phase lasts 61.4 months — or just over five years.

The S&P 500, which is the most popular index in the annuity world, has dipped below 4,000 in August and is down approximately 17% YTD. It’s on sale. And if history is any indication, it’s ripe for a bounce-back.

How can an investor take advantage of our rising interest rate environment and high rate-guarantees, while also having additional upside potential tied to the performance of the equities markets?

Enter Ibexis’ MYGA Plus product.

This newly engineered concept is unlike anything we’ve seen in an annuity product offering.

Let’s break down how it works.

MYGA Plus Overview

The MYGA Plus is a multi-year guaranteed, single premium annuity issued by Ibexis Life & Annuity Company. The product launched in early August and will be sold through a select distribution of independent marketing organizations (IMOs).

At its core, the MYGA Plus functions similarly to a traditional MYGA product and credits a guaranteed fixed simple interest rate. A client may allocate between 50% and 100% of paid-premiums to the Fixed Option.

The Index-Linked Option, or “Plus Bucket” is where the MYGA Plus separates itself from any other product in the marketplace. Clients have the potential to earn above and beyond what’s been traditionally available in a MYGA —- and they can take advantage of the inevitable rebound of the S&P 500.

At the beginning of the term, a client can allocate up to 50% of their premium to the “Plus Bucket”, which credits a guaranteed rate if the S&P 500 increases during any annual point-to-point period. The index doesn’t have to reach the cap — it’s performance-triggered. Even if the index increases .01%, a client will be credited the full Index-Linked rate. In years where the S&P 500 is flat or negative, a client receives a “0” for their “Plus Bucket” allocation but will still receive the Fixed Rate interest credit.

A client can make only one allocation choice at the beginning of the term and it’s set for the duration of the contract. However, both the Fixed and Index-Linked rates are guaranteed for the duration of the product. The current rates are below:

| Duration | Fixed Rate | Index-Linked Rate |

| 3-Year | 4.25% | 6.00% |

| 5-Year | 4.70% | 6.20% |

| 7-Year | 4.60% | 5.85% |

You’re probably thinking “Ok… so how often is the S&P 500 positive?”

Well, we ran the numbers.

S&P 500 Analysis Within MYGA Plus

From 1928-Present, on a daily basis, looking forward annually one-year, the S&P 500 is positive approximately 70% of the time.

Over the last 40 years, it’s positive approximately 80% of the time.

What does this mean for the MYGA Plus and how does it affect an expected client return?

Let’s look at the 3 and 5-Year durations individually.

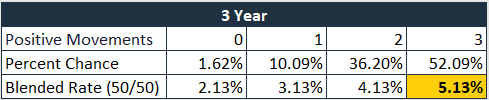

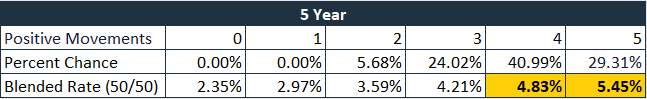

We’ll assume a client leverages the “Plus Bucket” to the maximum allowed 50% in each scenario. This gives us a 50/50 allocation between the Fixed and Index-Linked Options. The “Blended Rate” row is what the end client would receive for an interest credit, depending on the number of positive movements or “performance triggers” of the S&P 500. For the “Percent Chance” row, we used the last 40 years of S&P 500 price return data.

3-Year Interpretation

In the 3-year product, a client would need 3 positive performance-triggers to beat the fixed rate of 4.25%. Based on the table above, the chances of that happening are 52%. And, if it did happen, a client would yield 5.13% simple interest, or 4.89% compound.

This rate is head and shoulders above the current top of market 3-year MYGA rate of 4.26% compound.

5-Year Interpretation

In the 5-year duration, a client would need 4 out of 5 positive performance-triggers to beat the fixed rate of 4.70%. The chances of this happening are 70.30% and a client would yield 4.83% simple, or 4.42% compound. Great odds, in our opinion.

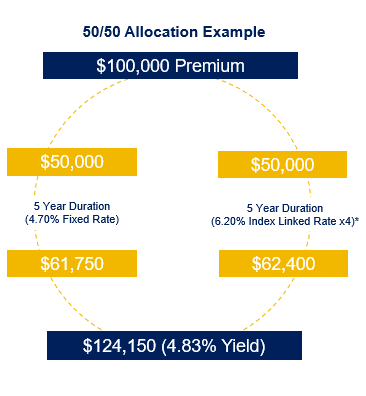

Here’s a breakdown of how that would look for an initial premium of $100,000.

A client also has a 29.31% chance of hitting 5/5 positive movements, which would yield a return of 5.45% simple or 4.94% compound — 39 bps higher than the current top of market 5-year MYGA rate of 4.55%.

Lastly, if a client wanted to take withdrawals for income purposes, 10% are available starting in Year 2, and they can elect from which bucket they want with the withdrawals processed.

Conclusion

For an understanding of the future, look to the past. It’s rare to time the market perfectly, and many skiddish clients and investors are sitting on cash due to continued volatility.

The MYGA Plus offers an incredible value proposition — earn a guaranteed, top of market fixed rate, and give clients exposure to the inevitable bounce back of the equities market with a performance trigger on the S&P 500, all within a tax-deferred wrapper. From our vantage point, there’s a great chance you’ll end up ahead in the long-run.

*cover image by Freepik