MYGAs are an extremely popular, conservative investment vehicle for many individuals approaching retirement. Given recent interest rate increases, the attractiveness of these products has increased substantially in recent months.

When evaluating the competitive landscape, one key decision point can be how interest is credited, either as Simple or Compounding. The recent launch of a MYGA with simple interest by a carrier called Ibexis Life and Annuity Company drew our attention and we felt that it would be worth our while to compare the Simple versus Compound interest crediting methods and how each might work based on client’s needs.

MYGA Comparison

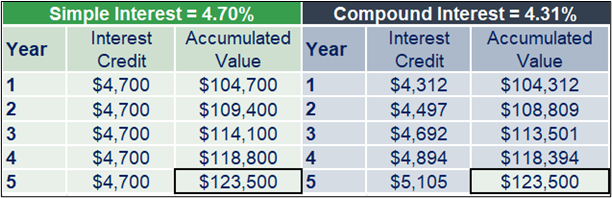

For a fair comparison, we’ll use two rate-equivalent 5-year MYGAs with an initial premium of $100,000. The simple interest MYGA pays a rate of 4.70% and compound interest MYGA pays a rate of 4.31% annually.

As you can see from the table of values, after the 5-year term, the clients have the same accumulated value.

Equal enough — yet the difference exists in what happens along the way.

Liquidity

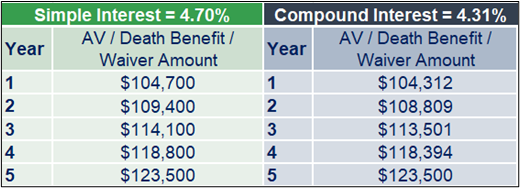

We don’t like to think about it, but what happens if a client passes away during the surrender term?

The simple interest option would pay a higher death benefit at every point until the end of the contract.

The same holds true for any waivers exercised. And because of a higher accumulated value, the cash surrender value would also be more in the simple interest option assuming an equal surrender schedule.

Income

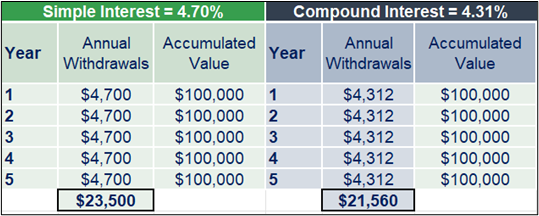

What if a client wanted to use their MYGA for income purposes? The following table shows annual interest-only withdrawals.

The simple interest option generates $23,500 versus the compound interest total of $21,560 — 9% more income.

For overall liquidity, and with all else equal, the simple interest MYGA provides more value.

When the end result (accumulated value) is the same, simple interest MYGAs can deliver more value intra-contract for consumers. If you’re writing MYGAs for your conservative clients, it might be time to evaluate the simple interest options available in the marketplace.