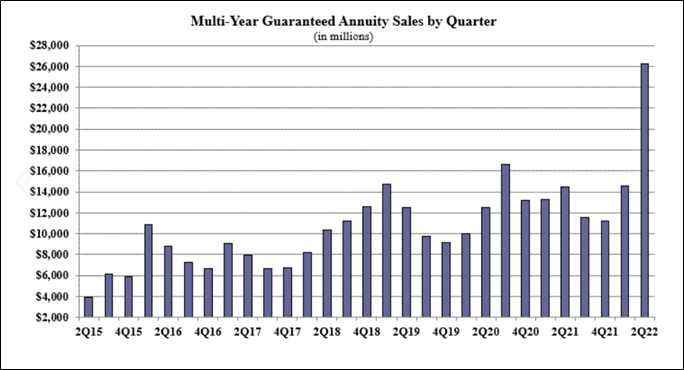

Multi-year guaranteed annuity (MYGA) sales have skyrocketed in 2022.

According to an article from InsuranceNewsNet, and data provided by Wink, MYGA sales were up 79.9% quarter over quarter, and 81.8% compared to 2Q21.

Source: Table from InsuranceNewsNet with data provided by Wink

Why?

For starters, 2022 is on pace to be one of the worst years ever for a traditional 60/40 portfolio. Equity markets have been pummeled. The S&P 500 is currently down 24% YTD and is in bear market territory.

And rising interest rates have crushed bonds. The 10-year Treasury breached 4% this week and sits at 3.77%.

Absent an investment into equities or bonds — surely a savings, money market account or certificate of deposit (CD) is a safe place to park cash, earn interest, and ride out the storm?

Well, yes, while most certainly safe and FDIC-insured, consumers are realizing the interest rates on bank deposit products are meager at best.

In this blog post, we’ll examine how bank products, which typically increase their offered rates on products such as CDs, in direct correlation with benchmark interest rates, haven’t kept pace with MYGAs.

And consumers, who are hungry for safety and yield, have developed an appetite for MYGAs, and their high rate-guarantees.

With continued interest rate increases will the spread between bank issued products and MYGAs continue to widen and make MYGAs even more attractive? Or will we see banks begin to clamor for customer deposits and begin offering higher rates? Let’s dive in.

Offered Rates: A Brief History

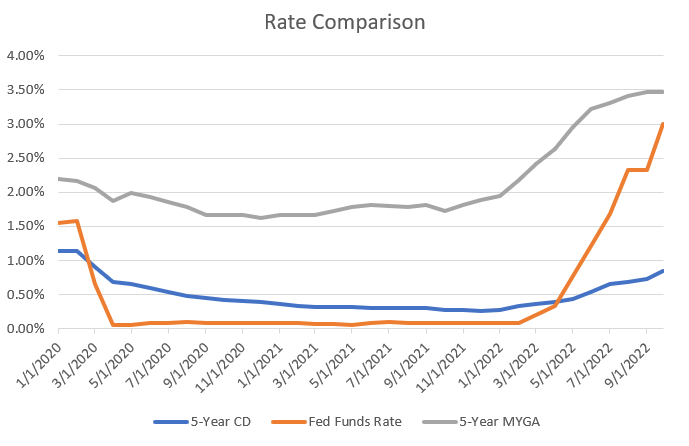

The COVID-19 pandemic in early 2020 caused the Federal Reserve to lower interest rates (federal funds rate) to near zero in effort to stimulate economic growth. This caused CD rates from banks to drop dramatically (represented by the blue line in the graph below). The low-point for average 5-year CD yields was .26% in December of 2021. The average 5-year MYGA rate during the same month was 1.89%.

The spread between the average CD and MYGA during this time was 1.63%.

*Data compiled from Bankrate.com and FRED Economic Data

Fast forward to now.

In effort to combat inflation, the Federal Reserve raised interest rates by 75 basis points for the third consecutive time after its September 2022 meeting. The target federal funds rate is now 3.0 – 3.25%. It’s represented by the orange line on the graph above.

Historically, CD rates have mirrored movements in these benchmark interest rates — but there’s often a lag between any rate adjustments and the offered rates seen at banks — typically multiple months.

The average 5-year MYGA rate currently sits at 3.47% while the average 5-year CD rate is .84%.

Spreads have widened considerably — all the way to 2.63%.

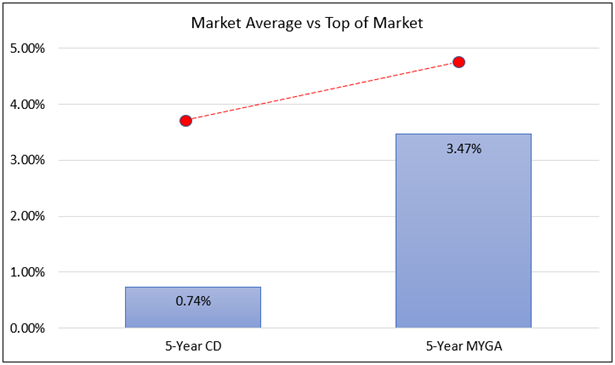

Top of Market vs Average CD Rates

One thing you might notice when evaluating CDs in the marketplace is the tremendous disparity, or spread, between the average rate, and top of market rate.

The current spread within 5-year CDs, between the average offered rate (.74%) and top of market rate (3.75%), is over 3%.

But, not all banks are created equal.

Sticking with the 5-year duration, here’s the list of top-of-market CD offerings from Bankrate.com.

Notice any major bank players missing?

| Bank | Rate |

| Bread Savings | 3.65% |

| Capital One | 3.50% |

| Synchrony Bank | 3.50% |

| Popular Direct | 3.40% |

| Marcus by Goldman Sachs | 3.30% |

| Citizens Access | 3.30% |

| Barclays | 3.25% |

| Bethpage Federal Credit Union | 3.25% |

| Alliant Credit Union | 3.25% |

| BMO Harris | 3.25% |

| First Internet Bank of Indiana | 3.25% |

| TAB Bank | 3.25% |

| TIAA Bank | 3.25% |

| Discover Bank | 3.25% |

| LendingClub Bank | 3.25% |

| Sallie Mae Bank | 3.25% |

*Source: Bankrate.com

The big boys. JP Morgan Chase. Bank of America. Citigroup. Wells Fargo. US Bank. PNC. Truist.

There are quite a few factors at play here but we assume many of the larger banks are flush with deposits. Another factor could be the Fed currently paying 3.15% on bank reserves and excess reserves.

As you can see from the table, offered rates on CDs tend to be higher for online-only banks and regional banks & credit unions.

We assume goal for these types of banks is to gain clients with high rates on deposit products, and then provide additional services to the consumer down the line — or gather more client assets.

Bottom line: many want deposits because they need deposits.

Conducting due diligence on any financial institution (or insurance carrier) before placing a large investment is always wise.

Top of Market vs Average MYGA Rates

You’ll find much smaller spreads in the MYGA world compared to Bank CDs. The current average MYGA rate offering in the 5-year space is 3.47%. Top of market MYGA rates are 4.80% — a spread of 1.33%.

*As of September, 2022. Source: Investopedia and carrier websites.

The top-of-market 5-year MYGA currently yields 115 bps more than the top-of-market 5-year CD.

And remember when the interest rates were near zero in December of 2021? The difference between the average 5-year MYGA and average 5-year CD was 1.63%. In September 2022, it’s 2.73%.

Even though MYGAs are paying interest head and shoulders above CDs, it isn’t the only differentiator between these two vehicles.

While MYGAs don’t have FDIC protection, they offer nearly the same level of safety from well-capitalized and highly regulated insurance companies.

They’re also fully tax deferred.

They possess liquidity provisions for income purposes.

And they’re often sold by advisors who can offer holistic financial advice and who can talk customers through their policy or financial wellbeing.

Conclusion

Ultimately, MYGAs are reigning supreme to their CD counterparts, and we believe this trend will continue in the future as most major bank players have stayed out of the CD market. We believe it’ll come as no surprise when MYGAs shatter more quarterly records in Q3 and Q4 of 2022.

It’s the perfect storm of economic chaos, and MYGAs will continue to serve as a safe harbor for producers and consumers for the foreseeable future.

Image by macrovector on Freepik